Do not use M1 Finance

But for now, DO NOT USE M1 FINANCE

I am an optimist when it comes to my long term plans and a super pessimist when it comes to believing random success stories that I hear on the internet. The internet is a hotbed to amplify our survivorship bias. And knowing that there are probably billions of people on the internet, the single success stories have a chance of 1 in a billion to replicate for me. I am automatically very suspicious of any claim on the internet especially countless number of Canadians who arrived to wealth by moving down south to the US and investing their $75K tech incomes in VTSAX to retire in 5 years. I am not saying their story has not happened, but I strongly believe, considering that all of these success stories have interestingly happened during one of the longest bull markets in the US history, their story can be hardly replicated.

Additionally, just like any semi-successful trend, the FIRE movement has attracted a large number of opportunists who are coming to the movement to make a few bucks. There are a few examples of 25 year olds whose portfolio, if you calculate their true return, is returning way above 50% annual returns (remember Bernie Maddof? his guaranteed return was 20% and Benjamin Graham, the legendary investor whose book “The Intelligent Investor” has given rise to value investing, the legend who trained icons like Warren Buffet have had about 38% return in their best days). To these people add a few who have built an empire by walking dogs, sitting cats, and driving for Uber. God knows what brought wealth to the rest of these people, maybe hard work, maybe a trust fund, or cryptocurrency laced CBD

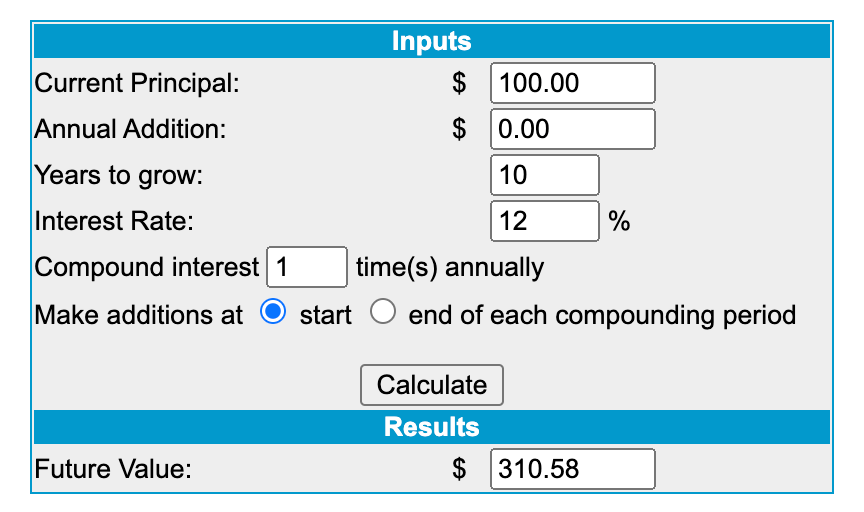

Let’s for the sake of argument say we have $100, and would like to invest it in a high growth asset that grows 12% on average for 10 years. The formula to calculate the compound value is

Future value = Initial investment * (1+ Interest)^ Years

If we plug in the numerical values after 10 years our 100 Dollar bill will grow into $310.58. A wonderful 310% growth. If you are lazy like I am, you can use one of the many compound interest calculators online to arrive at this exact number

This means that if I have $1M, I can probably safely Fat FIRE in 10 years even if I work as a barista for the next 10 years to pay the bills while the army of my little Dollar bills is growing to $3.1M to earn me retirement for the rest of my life.

What people don’t tell you is that this number is pretty much the best case scenario. It is essentially the optimal performance of your portfolio that completely ignores market volatility. Let me show you why. Let’s for the sake of argument imagine we are looking at an average of 12 percent growth over a short 2 year horizon. Also consider the following four scenarios which all have the average 12% growth but you will end up with different amount of assets at the end:

Scenario one:

Scenario two:

Scenario three:

Scenario four:

See, all of these scenarios have the same average growth over the 2 year horizon but the market volatility goes up significantly in the scenarios 2,3, and 4. In fact as the market volatility goes up your portfolio starts to perform worse.

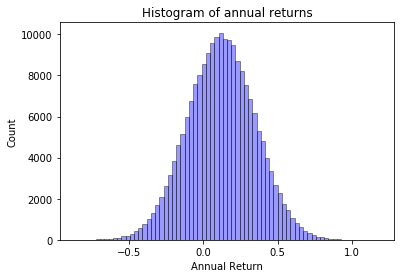

Let’s build a small simulator to estimate our portfolio’s return in various regimes of volatility. I assume that my portfolio can produce a return between -100% to 300% every year and this return is normally distributed around the mean of 12%. This way I can vary the standard deviation of the samples as estimate my portfolio returns more realistically.

The following little Python script generates random returns that are between -100% and 300% whose mean is exactly 12%

import numpy as np

# Generates t returns with average of mu

def generate_seq(min_val, max_val, mu, t, sigma):

s = np.random.normal(mu, sigma, t)

s = [min(max(x, min_val), max_val) for x in s]

mean_val = np.mean(s)

diff = mean_val-mu

s = [x-diff for x in s ]

return s

# Convenient wrapper for generate_seq

def generate_my_seq():

return generate_seq(-1.00, 3.00, .12, 10, .24)

d = generate_my_seq()

print(d)

print(np.mean(d))

As sample sequence of returns produced by this code will be

[0.4636707418453361, -0.015194351776261508, 0.12141853784353404, 0.19838200461651365, 0.20743710814249752, 0.4447197851379031, 0.24032558821925656, -0.22403723286831953, 0.03366595856070387, -0.2703881397211638]

That results in the exactly 12% average return

I can visualize the distribution of these returns using a simple code like this

vals = []

for j in range(0, 20000):

for i in generate_my_seq():

vals.append(i)

# Import the libraries

import matplotlib.pyplot as plt

import seaborn as sns

# seaborn histogram

sns.distplot(vals, hist=True,kde=False,

bins=int(360/5), color = 'blue',

hist_kws={'edgecolor':'black'})

# Add labels

plt.title('Histogram of annual returns')

plt.xlabel('Annual Return')

plt.ylabel('Count')

print(np.mean(vals))

print(np.std(vals))

I can now run my simulator for various values for volatility and calculate my final portfolio value

sims = 200000

init = 100

for sigma in [x*a for x in [0, .25, .5, .75, 1,2,3,4,5,6]]:

vals = []

for i in range(0, sims):

d = generate_seq(-1.00, 3.00, a, t, sigma)

y = init

for j in d:

y+= y*j

if y<0:

y=0

vals.append(y)

# seaborn histogram

plt.figure()

sns.distplot(vals, hist=True,kde=False,

bins=int(360/5), color = 'blue',

hist_kws={'edgecolor':'black'})

# Add labels

plt.title('Histogram of final values')

plt.xlabel('Compound Value')

plt.ylabel('Count')

print("-----")

print("sigma:", sigma)

print("mean:", np.mean(vals))

# print(np.std(vals))

print("min:", min(vals))

print("max:", max(vals))

#sorted(vals[-10:])

#sorted(vals[:10])

print("\n\n\n")

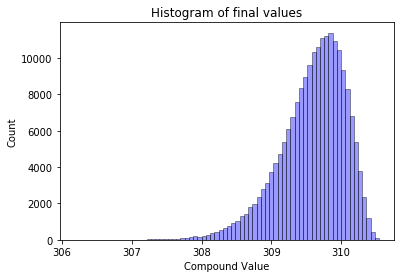

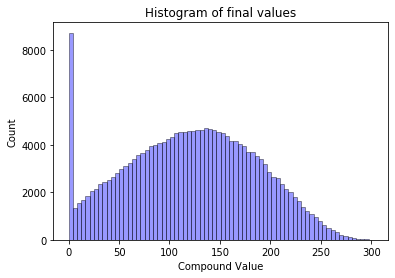

For zero volatility I arrive at my rosy FAT FIRE picture that the compound interest calculator gives me, I can fat fire in 10 years without any worries. All of those FIRE conferences were right, retiring on a $75K salary is so easy.

sigma: 0.0 mean: $310.58

However as I increase the standard deviation (volatility) of the returns my retirement slips away from my hands. Below is the results for the 3% volatility

sigma: 0.03 mean: $309.58 min: $306.22 max: $310.52

Still not bad, in the worst case scenario if the volatility is only 3% I will be able to retire with $306 dollars ($3.06M for my $1M portfolio), and the distribution of final values looks something like this (less variety on the upside and more chance of longer tail on the downside)

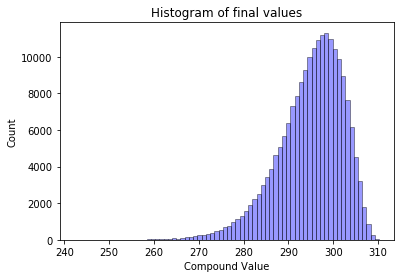

For an slightly more realistic case of having 12% standard deviation, I get the following. On average I will still have about $2.9M but I might end up with $2.4M and my best case scenario will never reach the FIRE calculator’s $3.1058M

sigma: 0.12 mean: $294.814 min: $242.329 max: $310.234

And if we have a 48% sigma I will have a large chance of going broke at the end of 10 years (look at the large bar on 0$ in the following graph)

sigma: 0.48 mean: 120.86 min: 0.0 max: 301.50

This doesn’t mean you shouldn’t invest. It doesn’t even mean you cannot Fat FIRE in 10 years. But what it tells you is that your friendly compound interest calculator is giving you the most optimistic scenario and you should not rely on it. For my retirement calculation I will probably use a more realistic 7 to 8% return with a volatility of 12%. Sure it means that I probably have to work for 3 more years.

Another thing that you need to know is that here we have used a long time horizon of 10 years and as time goes by you can recalculate your portfolio return to arrive at a tighter estimate for your retirement. Your estimate at year 9 is going to be more accurate than your estimate at year 0.

I have been a big fan of Vanguard for the past year, however it doesn’t let me buy QQQ or VGT as an automatic investing. Basically the only option I have is VTSAX which I buy four times a month and have been pretty happy with it. I look at it as our long term taxable investment.

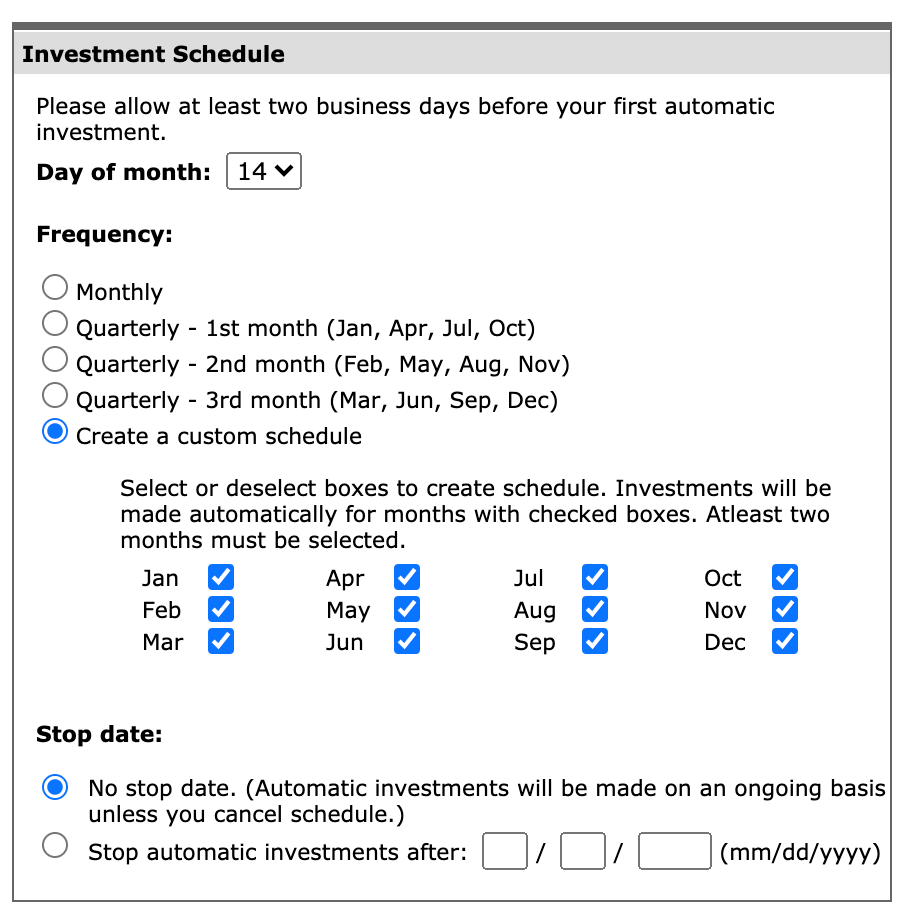

Recently I have been looking into adding Fidelity to my tools that I use for dollar cost averaging. In theory it should allow me to buy any stock, ETF or even a basket on a cadence. However, at first glance, it seems Fidelity only allows for once a month investing.

From what I see, unlike Vanguard I cannot invest 4 times a month into the market and I am limited to only once a month.

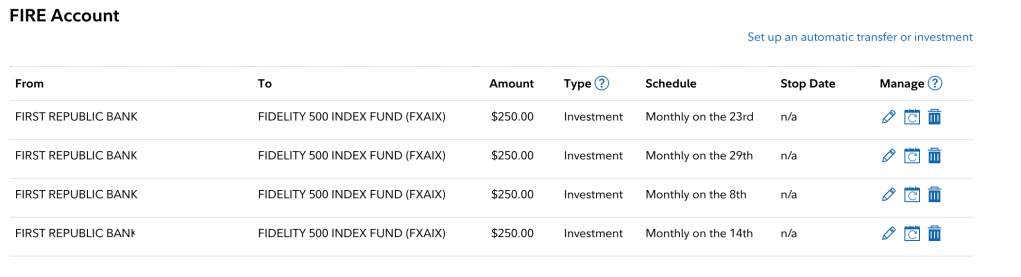

However nothing stops you from creating multiple automatic orders and almost replicate what Vanguard does without a hastle

Below I have scheduled 4 separate automatic investments on the 8th, 14th, 23rd and 29th. The money goes from my First Republic Account to our FXAIX account.

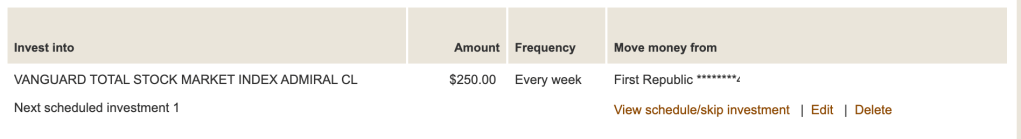

Compare this to how easy it is to schedule weekly investments on Vanguard.

I am hoping that at some point, Fidelity gets its act together and fixes their painful automatic investing plan

Backdoor Roth is a way for high income people to sock away $6,000 after-tax per individual (or $12,000 for a couple) into a Roth IRA. You will pay the tax on the money that goes into the account but any future growth is tax free. Performing a backdoor conversion is a one way street and you are prohibited from undoing it. So think carefully before performing this trick.

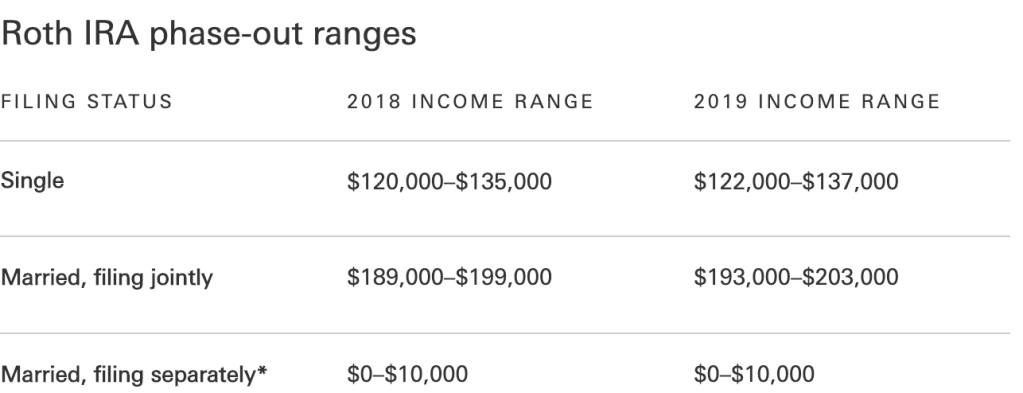

If you are a high income earner you are probably not qualified to contribute to an IRA. The Internal Revenue Service considers you “Phased Out” (check the income limit here on the IRS website). The trick here is to use what is known as “Backdoor Roth IRA” conversion.

If you are a single income earner and making more than $137K or you are married and making over $203K you are not qualified to contribute to Roth IRA and you can only use the backdoor Roth technique that we are talking about

Here are the steps that you need to follow:

The only hurdle I faced was that for my wife I had to start a new Vanguard account and the system did no allow me to move the funds after only 2 days. Apparently I had to wait for 7 days.

You need to open two accounts on Vanguard.com. One traditional and one Roth IRA. I went through this step for my wife and it took me less than 5 minutes. After opening both accounts you need to fund your traditional account up to IRS’s limit. In 2021 the limit is $6,000 but I really recommend you fund it up to $5,990. The reason being if you forget the next step, your account starts gaining value and might exceed the IRS limit, complicating the process. If you fund your account to $6,000 and your account gains a cent or two as interest you can still convert to Roth IRA and just pay the tax for that two cents (which is effectively zero). I recommend you use a money market fund as your settlement fund.

Remember that you should not fund your Roth IRA. and Just use “add money later” when you open your Roth IRA account.

The rest is explained by Vanguard as follows.

When funds are coming from outside of Vanguard, you will need to wait seven calendar days after contributing before you can convert to a Roth IRA. Once your contribution has settled and the funds are fully available, you’ll be able to convert the assets to a Roth IRA.

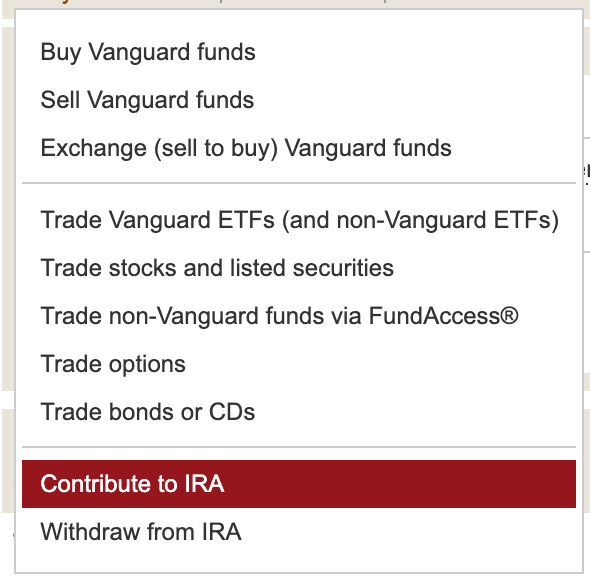

To convert to a Vanguard Roth IRA, follow these steps:

1. Log on to your account at vanguard.com.

2. From the “My Accounts” dropdown, select “Balances & Holdings.”

3. Under your pre-tax IRA,” select “Convert to Roth IRA” and follow the instructions. When you convert to a Roth IRA, your traditional or rollover IRA assets are distributed from the original account and rolled over to the Roth IRA. You’ll generally have to pay income taxes on the money you convert. If you’ve made only nondeductible contributions to your IRA and it’s the only pre-tax IRA you own, ordinary income tax would be due only on the earnings portion of the conversion. Roth IRA conversions are taxable within the calendar year they are completed, even if you’re converting previous year contributions. Vanguard will send you IRS Form 1099-R in January of the year following the conversion showing the amount that you distributed from your IRA. We’ll also mail you IRS Form 5498 by May 31 the year following the conversion reflecting the conversion into your Roth IRA. Please note that you’ll also need to file IRS Form 8606 with your income taxes to calculate your taxable amount and report your Roth IRA conversion. Pro Rata rule >> If you’ve made nondeductible contributions to your IRAs, a portion of your conversion amount–based on the percentage of your total IRA assets that is nondeductible–won’t be subject to tax. For example, if 20% of the contributions you’ve made to all your IRAs (which could include traditional, rollover, SIMPLE, and SEP-IRAs) were nondeductible contributions, then 20% of the amount you convert is not taxable and 80% is taxable. This applies even if you convert only assets in IRAs holding only deductible contributions. It also applies to any after-tax amounts from an employer-sponsored plan that you’ve rolled into an IRA. For more information on tax reporting requirements for Roth conversions, go to: http://personal.vanguard.com/us/insights/taxcenter/rothira-conversions Several factors can affect your Roth conversion decision. Therefore, you may want to consult with a qualified tax advisor before taking action. You can also get more information at: http://personal.vanguard.com/us/insights/taxcenter/planning/is-a-roth-conversion-right

It has been a few months since I have performed my Roth IRA and it has been a breeze.

It is very normal for anyone on the fire path to feel anxies about their net worth. After all if you are planning for retiring on a limited investment portfolio every little movement in the market can cause emotional changes for you. These are the ways that I use to track my net worth without adding to my anxiety

Hope these help. They have helped me tremendously and I don’t really have a money anxiety anymore. Instead I just focus on my family and work.

There are many reasons to be thankful this Thanksgiving. I am thankful to have a loving family, and my health to be able to support them, be with them and enjoy my life near them. Every year there are a few items that I go over to make sure my family and I are in the best shape either financially, physically and emotionally. This list might help you

I love my career, in other words, I am a very happy rat in this boring rat race. For a while I was wondering what would I be doing if I hit FIRE and don’t ever need to work anymore. To be honest that life would be meaningless to me, I wake up thinking about challenging problems and I go to bed thinking about them. I love the intellectual challenges. You know, vacationing more than two weeks actually makes me bored. But so does not vacationing for more than three months. I like the balance. I just don’t want to get stuck in either work or vacation. I like to have the flexibility of experiencing both.

That said, my career hasn’t been always fulfilling. At times I had faced real morons as my bosses, or been in toxic situations that I wanted to get out of. And because I did not have the financial means, I had to stay longer in those situations than I wanted to. I honestly think bad situations at work lowers your IQ and I avoid them religiously. You should too.

That’s why the following video by JL Collins resonated. My wife and I live on an annual expense of $110K and my FU money is having twice that (I am not bragging but we have surpassed that many years ago). Meaning that I can quit my job, go do nothing for two years but vacationing in Sydney, Lisbon and Singapore, maintain my current life style and still come back with all my retirement and house equity intact. This is the worst case scenario which assumes both myself and my wife quit at the same time which is extremely unlikely. But again if that happens, our current assets can easily support us for 4 or 5 years. Because we have reached our FU money.

I don’t need to retire, I just need to sleep thinking that if I lose my job I can still wake up happy and content. I take that over an eternity of frugality and FIRE lifestyle any day.

One of the questions that is probably on your mind is how can I get the most out of my by weekly paycheck?

One great solution is to ask your employer to direct deposit it in a high yield saving like Ally, American Express or Discover savings and collect a 2% interest. This by itself is a $2,000 free money on a cash reserve of $100k that most people keep in their savings anyways.

My wife an I did not have a high yield savings account and I looked into whether or not I should open one. The plan was for our salaries to go into a high yield saving from American Express and then from there for us to deposit it to various investment accounts or pay our mortgage and bills. This is still on my todo list. We have an account with First Republic that is a relatively local bank and we are happy with their 0 international fee ATM cards. However their savings account gives us peanuts compared to any of the online banks.

We however religiously do a dollar cost averaging through Vanguare, we feel this is more appropriate for us. Our salaries go directly to our First Republic account and then every week Vanguard takes $1,250 out of it and invests in VTSAX (VTI is more tax efficient but I have not figured out how to automatically invest in VTI). That way we can get a dollar cost averaging benefit and also not manually modify our strategy.

You can set it up very easily by going to

My accounts > Account maintenance> Automatic Investments

And setting it up to deduct weekly cash from your bank and invest into a Vanguard mutual fund.

I am personally comfortable doing a weekly investment in VTSAX and do not feel the need to diversify that further. I am slightly bothered that I cannot invest into VTI directly and I hope there is some way to correct that. The only remaining optimization is for me to move our cash reserve to an online savings account to get that $2K funny money back from our bank.

We talked about HSA accounts and why you should have one. If you still need more convincing you can look into my other post “What is an HSA anyways“.

When it comes to investing, automation is your best bet. You should automate your investment so 1) you cannot fiddle with it too much and as a result get a better return, that’s why dead investors often outperform active investors. 2) you want to spend your precious time on family or on yourself, you shouldn’t constantly be on a call with Vanguard or some other bank.

My HSA used to be a mess. Every two weeks I had to log into my account, rebalance, and move my excess money to the investment part of my account. It took me a few months to realize that my bank can automatically take any new deposits from my employer and transfer them to my pre-determined diversified portfolio.

If you have not done this yet, you should stop what you are doing, log into your HSA account and automate investments.

Imagine you are saving for an early retirement, you are maxing out your 401k, doing a backdoor Roth, and putting the rest of your money in a Vanguard investment account. You are doing great but unless you plan to die at 65 you should also think about maxing out your HSA account to pay for your retirement after you are 65. HSA is a wonderful tool and still one of the few vehicles that is accessible to everyone regardless of their income level. If you are into the FIRE movement (financial independence and retire early) you should absolutely have one.

So what is an HSA? HSA is a triple tax-sheltered account and if you live in the US and you are not maxing your HSA you are probably losing money. I see only one reason to not max out an HSA account and that is if you are saving for a big purchase like a house or a wedding or you have a huge unhealthy debt like a high interest credit card debt. Even if you have a mortgage you are probably better off saving for HSA assuming your interest rate for the mortgage is within healthy levels.

Triple tax sheltered means your deposits are tax free, your money grows tax free and your withdrawals are also tax free. I use HSA as part of my retirement planning and you should too.

A Health Savings Account (HSA) is a bank account, a combination of a savings account and trading account that are both tax deductible and work even better than your Roth IRA and your 401k. As we said, you invest in it tax free and withdraw from it tax free. I do use it to plan for my later days and you should too. An HSA won’t help you much when you are in your 30s or your 40s but after you are 65 you can withdraw from it without any penalty. Even before that, you can use it to pay for your medical expenses, your dental work, or whatever your insurance does not cover, I don’t touch my HSA money however and just leaving it there to grow. So imagine you expect to live until you are 90. My personal plan is to have enough money in my HSA to pay for the last 25 years for myself and my wife. With that reasoning whatever I can save in my HSA is justified and I do in fact max out my HSA every year ever since we bought our house (before that we were too focused to save for the down payment).

For an HSA you have to be enrolled in a high deductible healthcare plan. Which means you pay a smaller amount of money for your healthcare (big plus), your company will probably deposit some money into your HSA account too, say $1,500 (another big plus) and you can also deposit another $5,600 to your HSA to save for your retirement (the maximum you can add to your HSA is $7,100 for the year of 2020. This means the sum total of your contributions and your company’s contribution cannot exceed $7,100 in the year of 2020).

That said, if you are one of those people who get sick frequently and burn through your deductible every year then a high deductible plan is not probably useful for you but if you are healthy I recommend looking into switching to a high deductible health plan.

In your HSA account you can invest your money in various investment options. Below is the breakdown of my diversified investment. This is what I am comfortable with and you should set your own diversification plan. Plan to have a good mix of various investment options.

For more information, these series of videos can help you understand HSAs

Related links: